tax exemption on rental income from residential homes

Landlords of qualifying non-residential properties can refer to the Tax Treatment of Rental Relief Measures under the Rental Waiver Framework for Year of Assessment 2022. Contact HMRC if your income from property rental is between 1000 and 2500 a year.

Tax On Rental Income How Much Tax Do You Owe Landlord Studio

2 Order 2019 was subsequently approved and gazetted on 27 February 2019.

. Income from a rental property is taxed as ordinary income with a real estate investor paying tax based on their marginal tax bracket. Yes you can claim an income tax exemption on both house rent allowance HRA and repayment of home loan. SIMPLIFICATION OF GST ON RENT.

If you are living in a house on rent and servicing home loan on. Above 12570 and below the higher rate threshold of 50270 - youll pay 20 in tax on rental income Above 50270 and below the additional rate threshold of 150000 youll. 50 of basic salary if he.

Owner-occupiers typically dont produce assessable income from their main residences so the ATO exempts them from paying capital gains tax on the sale of their home. The Tax Cuts and Jobs Act changed the alternative depreciation system recovery period for residential rental property. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms.

Rental expenses to claim Renting out part of a home If you are only renting part of your home for example a single room you can only claim expenses related to renting out that part of the. Rent-a-room relief is an initiative which allows homeowners to earn rental income tax-free the income is not liable to PRSI the Universal Social Charge or income tax. This is your property allowance.

The Tax Appeal Tribunal TAT or the Tribunal sitting in Lagos on 10 September 2020 decided in the case between Ess-Ay Holdings Limited EHL or the Appellant and Federal Inland Revenue. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I.

You do not have to register file or claim GST for your rental income or expenses. The total expenses to be set off against rental income amounts to R38 027. Actual HRA component of salary.

So from 18th July 2022 RCM is applicable on renting of residential dwelling from Any person to registered person. From the rental income a property owner is allowed to deduct municipal taxes on the property rent that is not realised a 30 standard deduction on the annual value of the property as well. As per the income tax rules the tax-exempt part of the HRA House Rent Allowance is the minimum of the following amounts.

The rental income commencement date starts on the first day the property is rented out whereas. If you let out residential property a dwelling house you may be able to claim a deduction for the cost of replacing domestic items such as. If you earn income from renting out a property or even subletting a room in your home you need to pay tax on it.

The learned counsel appearing for the assessee submitted that the issue involved in these appeals is no more res integra as this Court has decided in the case of Chennai. The first 1000 of your income from property rental is tax-free. The idea is that income from the renting of residential.

The difference between the rental income and the expenses is taxable income in this case R11. Movable furniture for example. The general recovery period for residential rental property is 275 years.

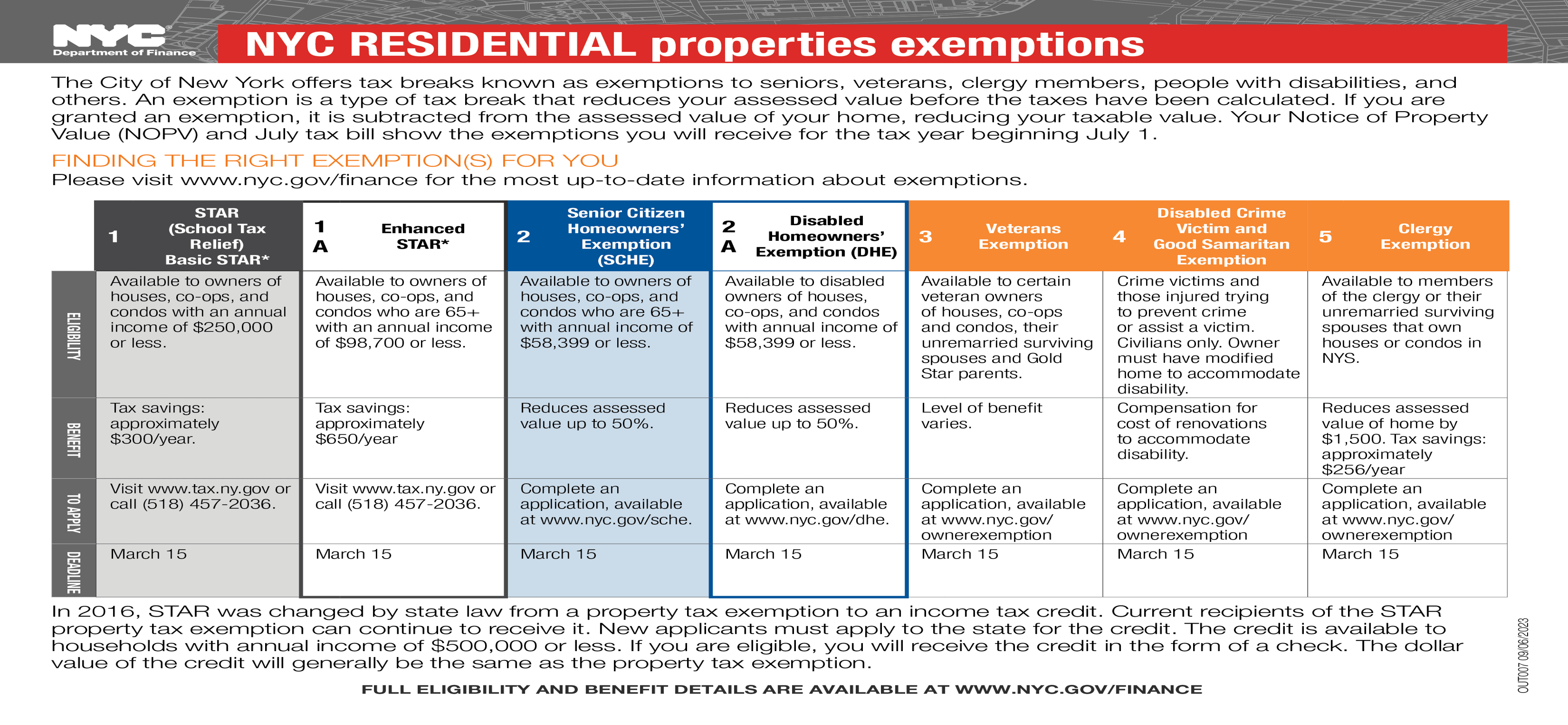

Tax Exemption On Rental Income From Residential Houses To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018. In relation to this proposal the exemption order Income Tax Exemption No. Federal income tax brackets in 2001 range from 10 up to.

It doesnt matter if its your only source of income or. Residential rental income from renting out long-term is exempt from GST. Renting out short-term is a.

To Simplify GST on Rent.

How Much Tax Do You Pay When You Sell A Rental Property

Self Made Millionaire Don T Buy A Home Unless You Can Afford To Waste Money

Why Buy Your Parent S Home And Rent It Back To Them Mark J Kohler

How Is Rental Income Taxed The Advantages Of Being An Owner

Understanding The Schedule E For Rental Properties Rei Hub

Claiming Property Taxes On Your Tax Return Turbotax Tax Tips Videos

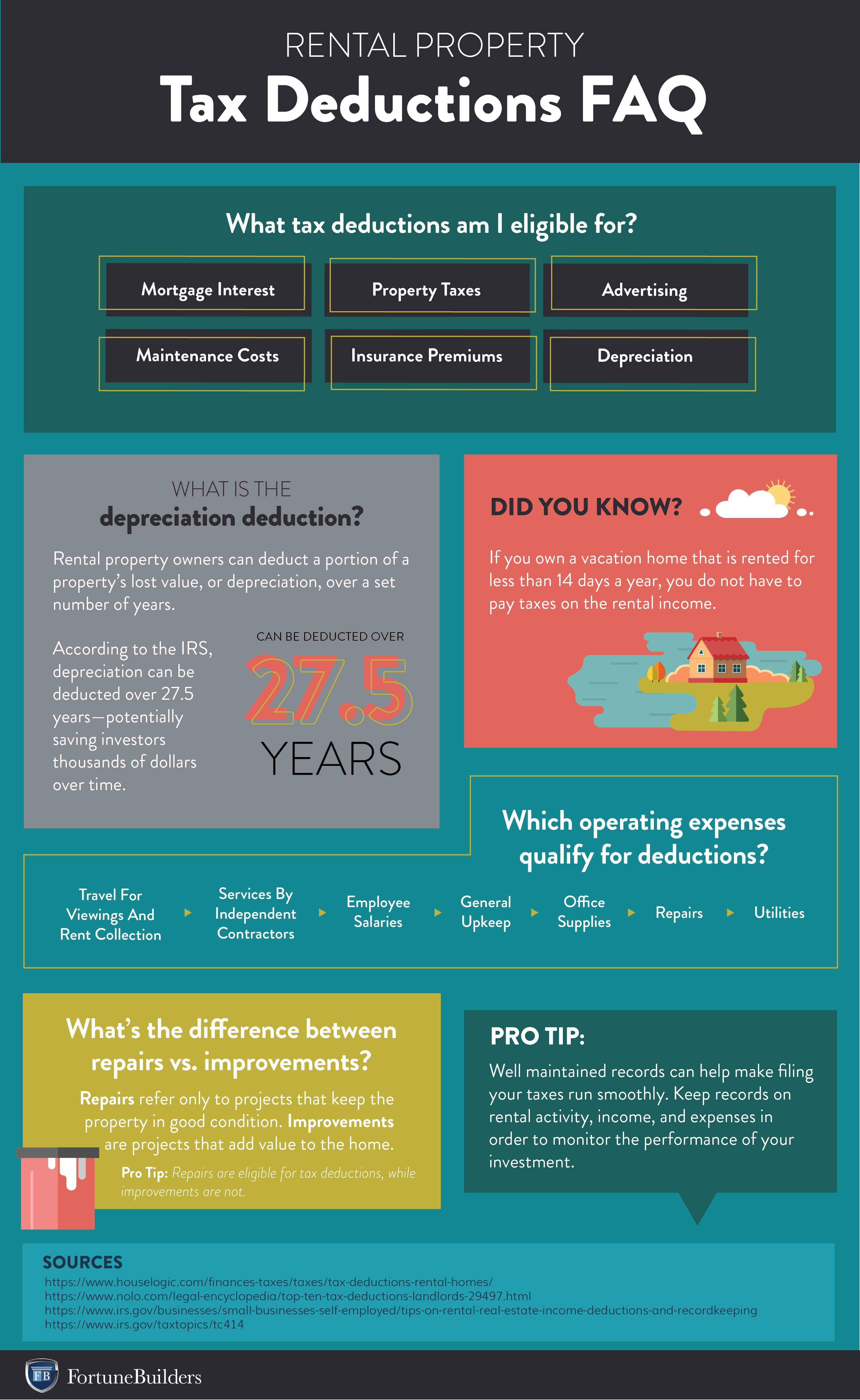

Rental Property Tax Deductions

5 Most Overlooked Rental Property Tax Deductions Accidental Rental

Rental Income Galactic Advisors

How Is Rental Income Taxed What You Need To Know Fortunebuilders

The Maze Of Real Estate Rentals

Tax Treatment Of Home Sharing Activities The Cpa Journal

How To Avoid Capital Gains Tax On Rental Property In 2022

9 Common Landlord Tax Deductions 2022 Update Stessa

Converting Your Home Into A Rental An Inside Look At The Benefits And Challenges Quicken Loans

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

10 Easily Overlooked Tax Deductions Vacation Rental Hosts Can Claim

The Irs Definition Of Rental Property

0 Response to "tax exemption on rental income from residential homes"

Post a Comment